Term Used Specifically to Describe Interest Rate

EMI is a fixed payment amount that is paidmade by a borrower to the lender at a specified time each month until the whole money is paid off with interest. Annual Percentage Rate APR is the interest charged for borrowing that represents the actual yearly cost of the loan expressed.

The Impact Of The Covid 19 Pandemic On Education International Evidence From The Responses To Educational Disruption Survey Reds

Serial bonds On January 1 Year 1 Hanover Corporation issued bonds with a 70500 face value a stated rate.

/dotdash_INV_final_The_Federal_Funds_Prime_and_LIBOR_Rates_Jan_2021-01-8010722eb0f94ecd9cbabd669c64e4e8.jpg)

. Similarly the annual percentage rate APR represents the total. The money supply in the economy decreases. Discount rate A central bank that wants to increase the quantity of money in the economy will.

Question 3 What term is used to describe the interest rate charged by the central bank when it makes loans to commercial banks. The daily periodic rate is. CDs may be secured or unsecured.

Question 7 3 out of 3 points What term is used to describe the interest rate charged by the Central Bank when it makes loans to commercial banks. CDs may have fixed or floating rates. EMI work on a set interest rate and set payment period.

WACC is an approximation of risk and some companies use the WACC as a discount rate. Open market rate Answer. Which of the following terms does not describe an interest rate used to calculate the interest expense on the income statement.

Maximum Price Total Payments Interest incurred. 1400 x 54 x 30 years x 12 months 1400 x 54 x 360 months. Term loans carry a fixed or variable interest rate a monthly or quarterly repayment schedule and a set maturity date.

See the answer See the answer done loading. What term is used to describe the interest rate charged by the central bank when it makes loans to commercial banks. Atlantic Bank is required to hold 10 of deposits as reserves.

If the loan is used to. Nominal interest rate is the interest rate before taking inflation into account in contrast to real interest rates and effective interest rates. Interest Rate and Fees.

The interest rate described in relation to a specific amount of time. The real interest rate was 679 in 2000 and 371 in 2010. Yield to maturity - Concept used to determine the rate of return an investor will receive if a long-term interest-bearing investment such as a bond is held to its maturity date.

A central bank that wants to increase the quantity of money in the economy will __________. Question 7 3 out of 3 points what term is used to. A percentage rate that reflects the amount of interest earned or charged.

What term is used to describe the interest rate charged by the central bank when it makes loans to commercial banks. Yield to maturity distribution - The average rate of return that will be earned on a bond if held to maturity. Absorption A term used by real estate lenders and developers to describe the process of renting up newly built or renovated office space or apartments.

What term is used to describe the interest rate charged by the central bank when the central bank makes loans to commercial banks. Interest Payment x Rate x Time. Which of the following is the term used to describe bonds that mature at the specified intervals throughout the life of the issuance.

Annual Percentage Rate APR. 504000 27216. Discount rate open market rate reserve requirement Fed rate.

The 2000 deflator was 24 and 51 in 2010. Like if you take a loan for 5 years you will pay the installments for 60 full months for each month. Open market rate 1 1 ptsQuestion 4 Which of the following is considered to be a relatively weak tool of monetary policy.

Increase of 1 million in Pacifics loan assets. Since it is just a simple interest and not compounding you just need to multiply the payment made the interest rate and how long you. Discount rate is also a term used to describe the interest rate charged to commercial banks and other institutions on loans from a Federal Reserve bank.

An analyst needs to adjust the nominal GDP for the years 2000 and 2010 into real terms to conclude his comparison analysis. Buy bonds in open market operations reverse quantitative easing raise the discount rate sell. Open market rate Fed rate reserve requirement discount rate DELL F5 F6 F7 F8 F4 24 7.

CDs may be for terms as short as one week or for terms of 10 years or longer. The monthly periodic rate for example is the cost of credit per month. This problem has been solved.

What term is used to describe the interest rate charged by the central bank when it makes loans to commercial banks. The interest rate on a loan is the money the lender charges a borrower for access to the moneyor the cost to borrow the money. The interest rate is.

Changing Discount Rate is a monetary policy tool. The term absorption period is often used to describe the period of time necessary for absorption. Decrease of 1 million in Pacifics net worth.

The nominal GDP in 2000 was 672 billion and 1690 billion for 2010. Increase of Pacifics bond assets by 1million. Certificate of deposit CD A deposit of funds in a bank or savings and loan association for a specified term that earns interest at a specified rate or rate formula.

ABS is always expressed as a monthly rate. However the discount rate incorporates a risk premium or cushion so its almost always higher than the WACC. An eligible Appointee designated by one of the ten University campuses Office of the President or LBNL as eligible to apply for a loan under the UC Home Loan Program.

After the loan repayment period the next loan terms to focus on are the interest rate and fees. Discount rate reserve requirement Fed rate open market rate Question 8 3 out of 3 points Which of the. 1400 x 360 months 27216.

More Effective Annual Interest Rate.

What Does The Federal Reserve Mean When It Talks About Tapering

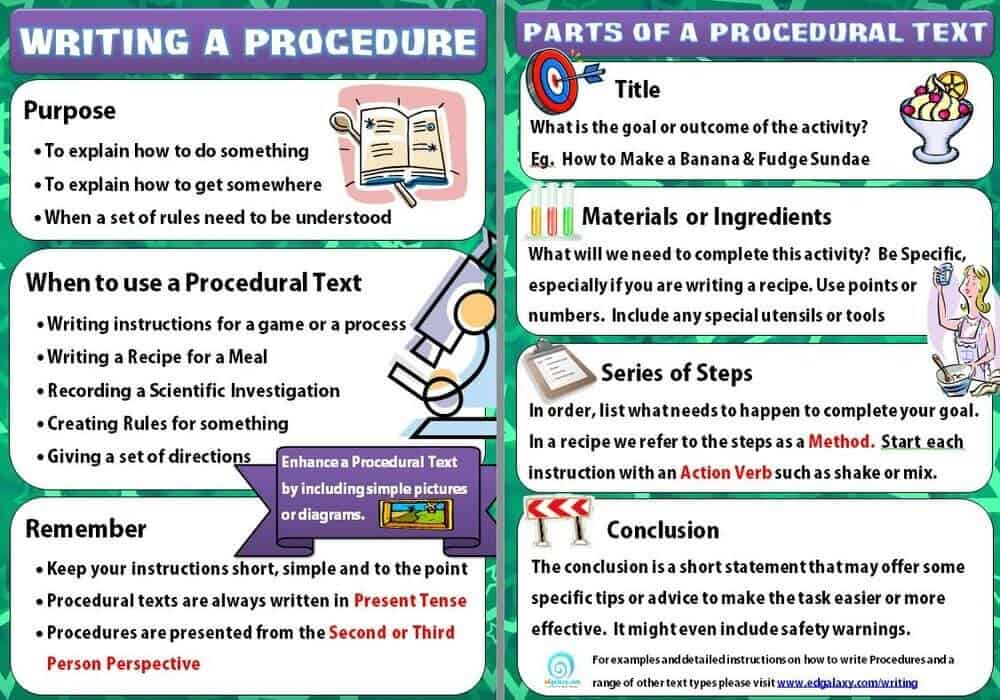

How To Write Excellent Procedural Texts Literacy Ideas

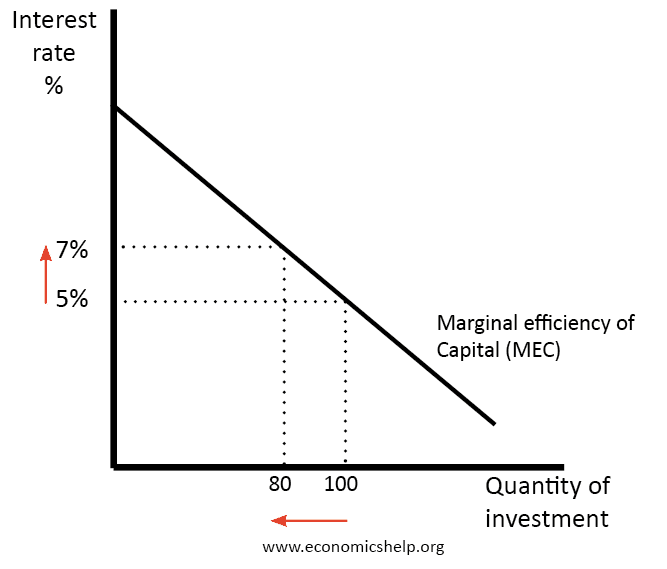

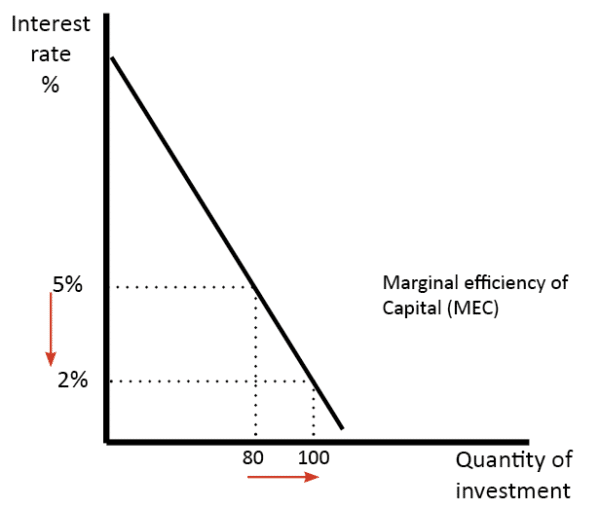

Investment And The Rate Of Interest Economics Help

Hypergrowth Mobile Marketing Harvard Business Review Marketing

Effective Annual Rate Ear How To Calculate Effective Interest Rate

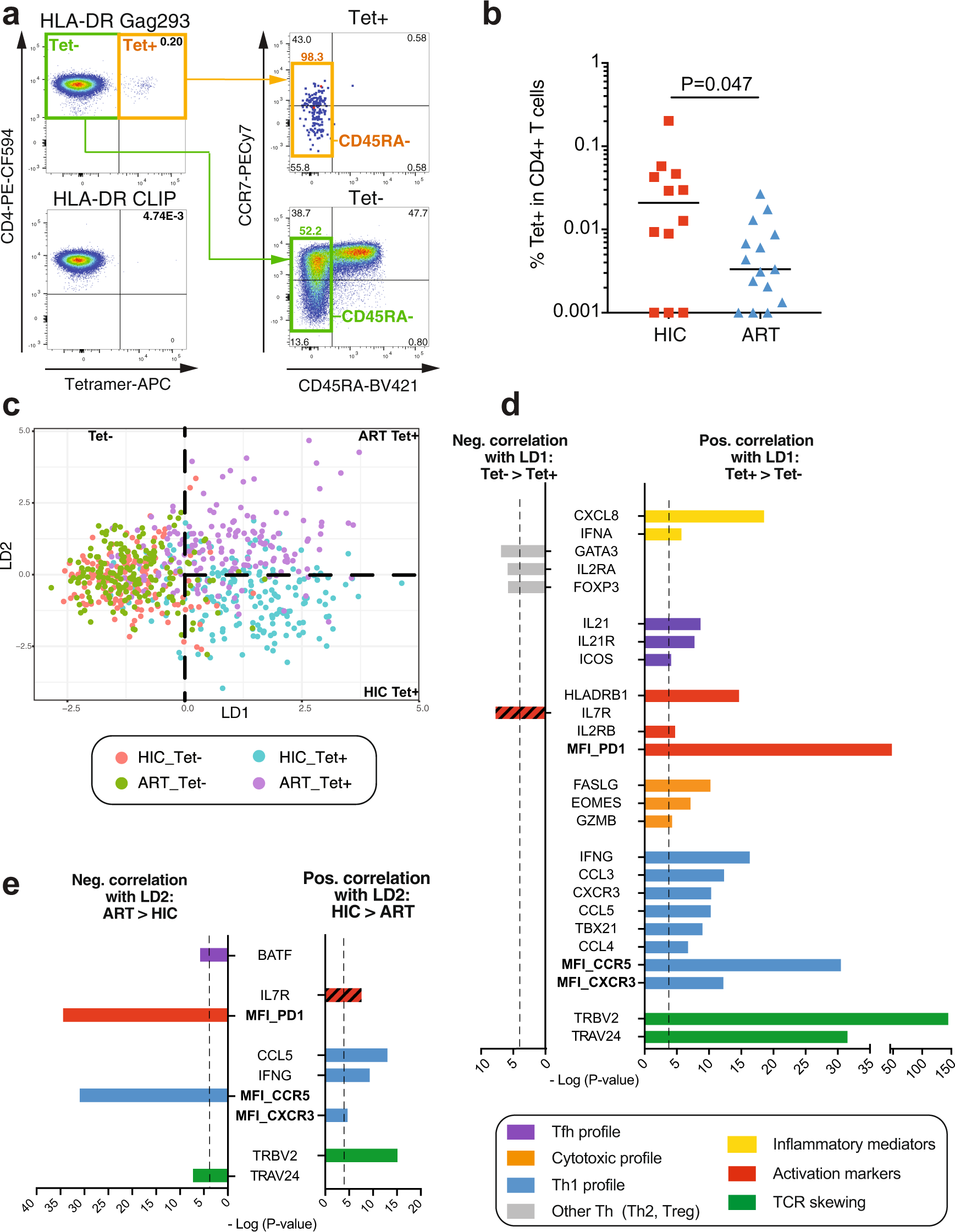

Low Ccr5 Expression Protects Hiv Specific Cd4 T Cells Of Elite Controllers From Viral Entry Nature Communications

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

How Are Bond Yields Affected By Monetary Policy

Interest Rate Calculate Simple And Compound Interest Rates

Investment And The Rate Of Interest Economics Help

:max_bytes(150000):strip_icc()/image55-cd3ea856bbe348d8a00fd1bdfbf2b1ea.png)

Time Value Of Money And The Dollar

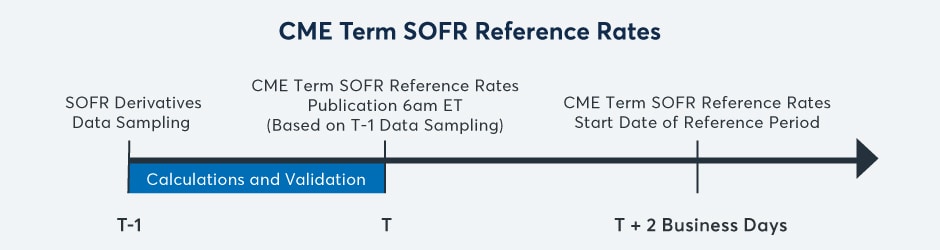

Cme Term Sofr Reference Rates Frequently Asked Questions Cme Group

/dotdash_INV_final_The_Federal_Funds_Prime_and_LIBOR_Rates_Jan_2021-01-8010722eb0f94ecd9cbabd669c64e4e8.jpg)

The Federal Funds Prime And Libor Rates Definition

Getting Real About Interest Rates Education St Louis Fed

/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

Comments

Post a Comment